The Agentic Future: Return to Fundamentals (TAO + GEOD) (12.9.25)

The Bittensor (TAO) halving grabs institutional attention, Chainlink’s “Link Everything” vision, GEODNET’s revenue breakout and Reppo’s upcoming subnets drive a big week across DeAI and robotics

This Crypto AI newsletter consists of three parts:

Snippet Partner (Bluwhale_AI)

Market Overview

Emerging Developments

If you have any questions feel free to reach out to me on X

Bluwhale AI is a Web3-native decentralized AI personalization protocol building the “Intelligence Layer” for crypto applications.

It transforms onchain wallet data into machine-readable profiles, enabling decentralized applications (dApps) to tap a shared, privacy-preserving dataset

The platform provides sophisticated AI-driven analytics with their flagship “Whale Score” product; a verifiable financial health score (0-1000) aggregating data across 37+ chains, traditional banks, and wallets for risk assessment and personalized insights.

The protocol is operational with multi-chain support across Sui, Arbitrum, Tezos, and Cardano through their upcoming Oceanum L3 zk-rollup.

The NFT Mint went live last week and trading will go live on Magic Eden soon, with teasing early access to its ecosystem for holders.

This newsletter goes out weekly to 6,960 subscribers.

Please don't hesitate to message me directly for sponsorship or partnership enquiries

AI Roundup

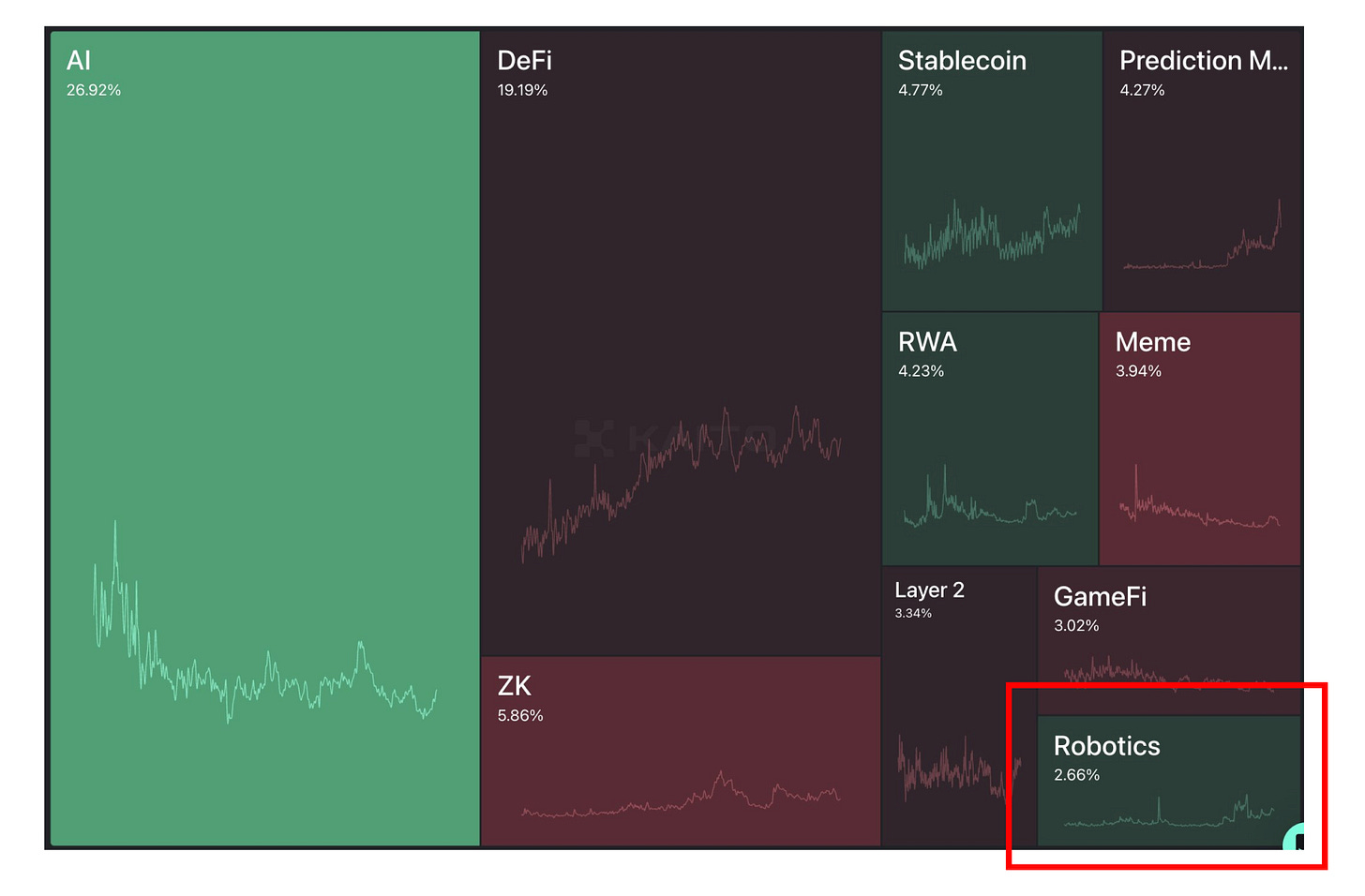

Decentralized AI (“DeAI”) mindshare pumped the most this week with a 2% surge:

Robotics continues to gain traction, partly driven for memetic value this week as Beeple creates some iconic robot dogs with Musk, Bezos and Zuckerberg’s heads.

The best part? When they took a photo “pooped” it out their backside:

While I don’t think the robo dogs will be too functional for your average household chore, it could become a “gateway robot” to the more functional humanoids.

Or perhaps a companion for your pet, which may then help the general public familiarize themselves with having machines in their homes.

a) DeAI Market Cap

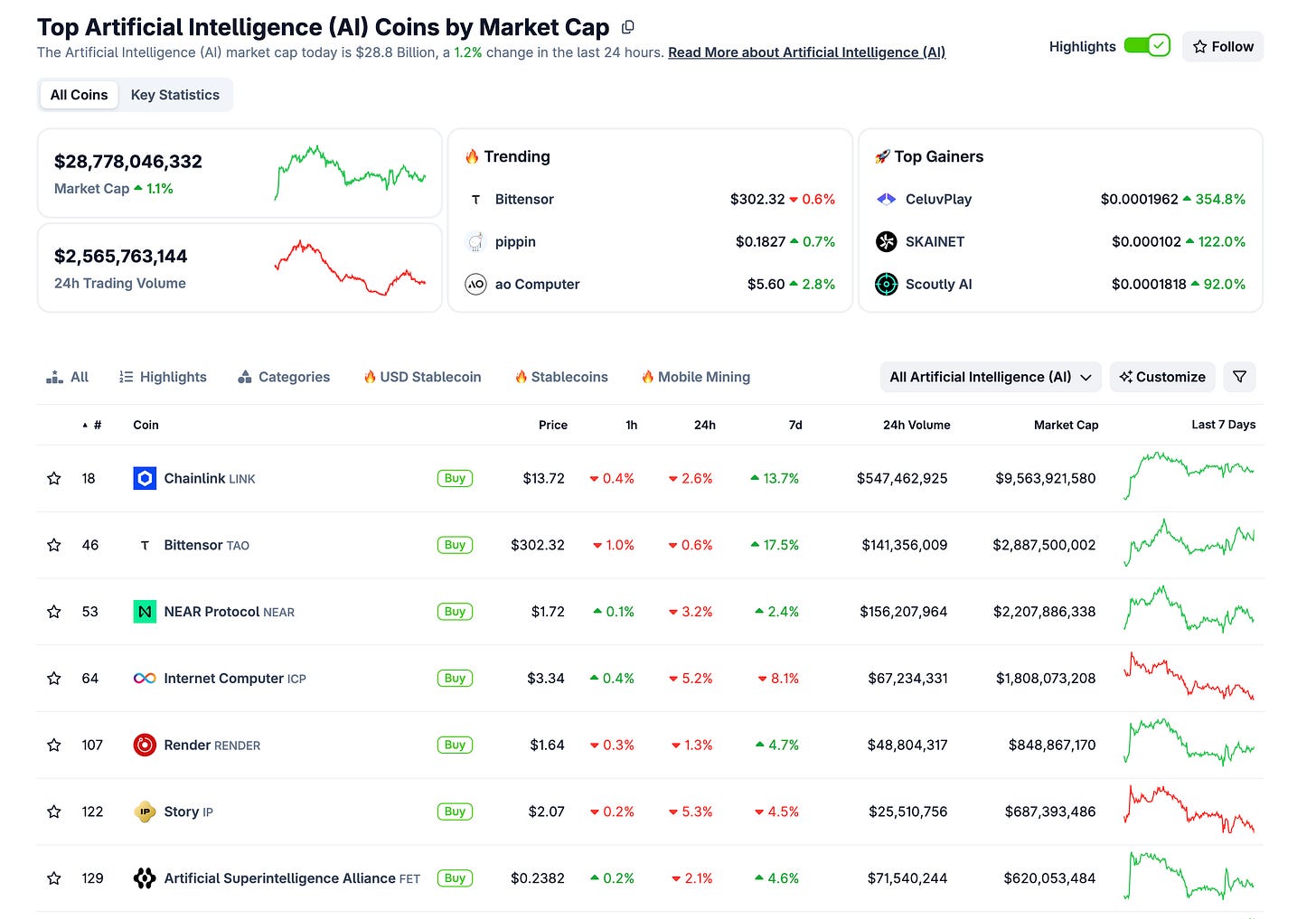

The overall DeAI market cap is up $1.3m (+5%) this week, predominantly driven by Bittensor (TAO) and Chainlink:

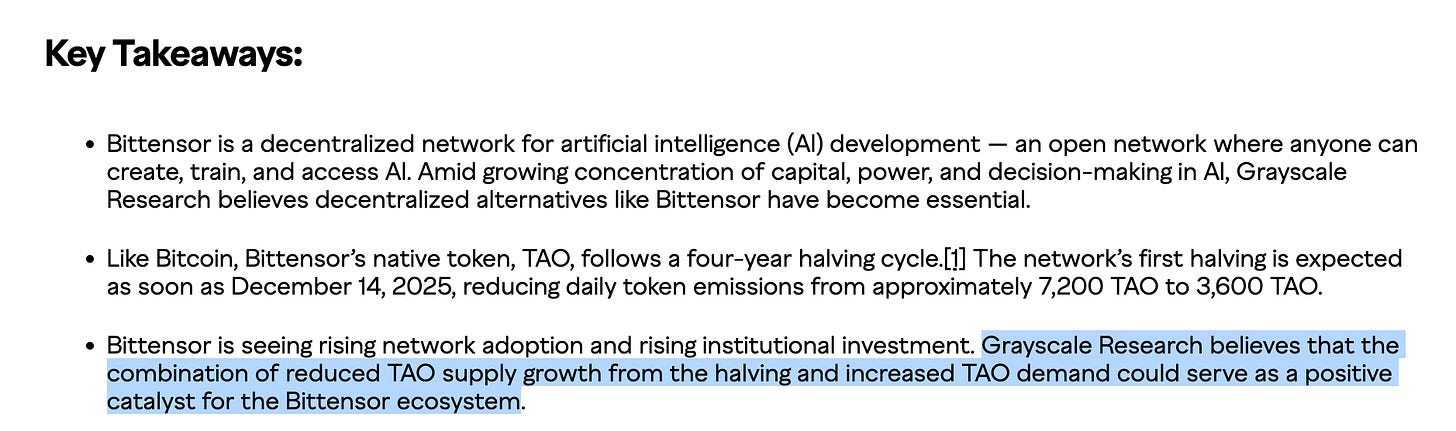

Bittensor (TAO): The halving is fast approaching later this week so speculators are inevitably going to trade the incoming supply crunch.

Chainlink: rolls out its “Link Everything” campaign as it brings the world onchain through a new vision. Grayscale also launched the first LINK ETF driving more institutional exposure.

Recent AI partnership includes Codec FLOW through its CRE initiative.

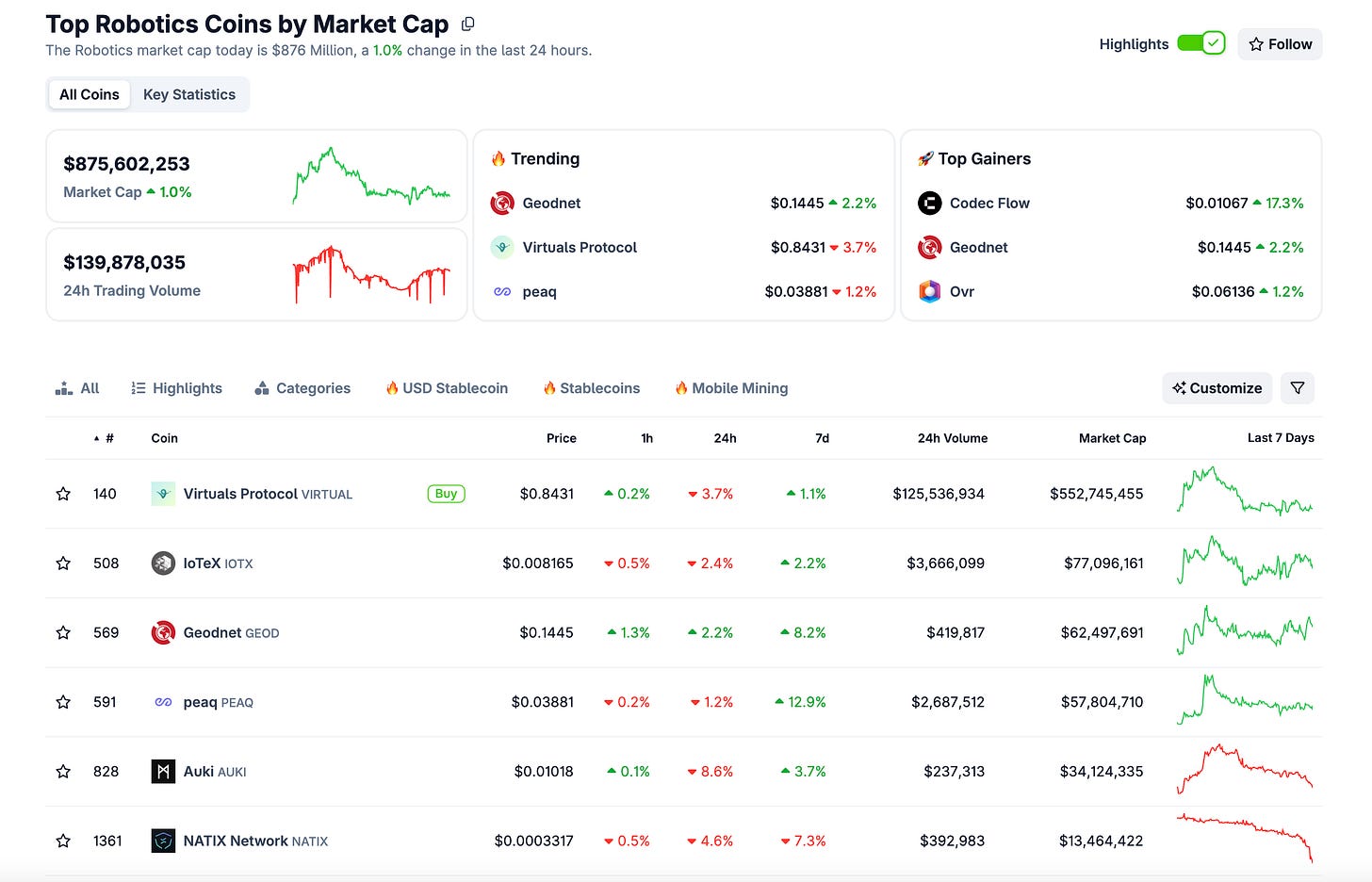

b) Robotics Market Cap

The Robotics market cap climbed by $9m (+1%) to $875m this week:

GEODNET and PEAQ outperformed this week, seeing 8 and 13% increases in market cap, respectively:

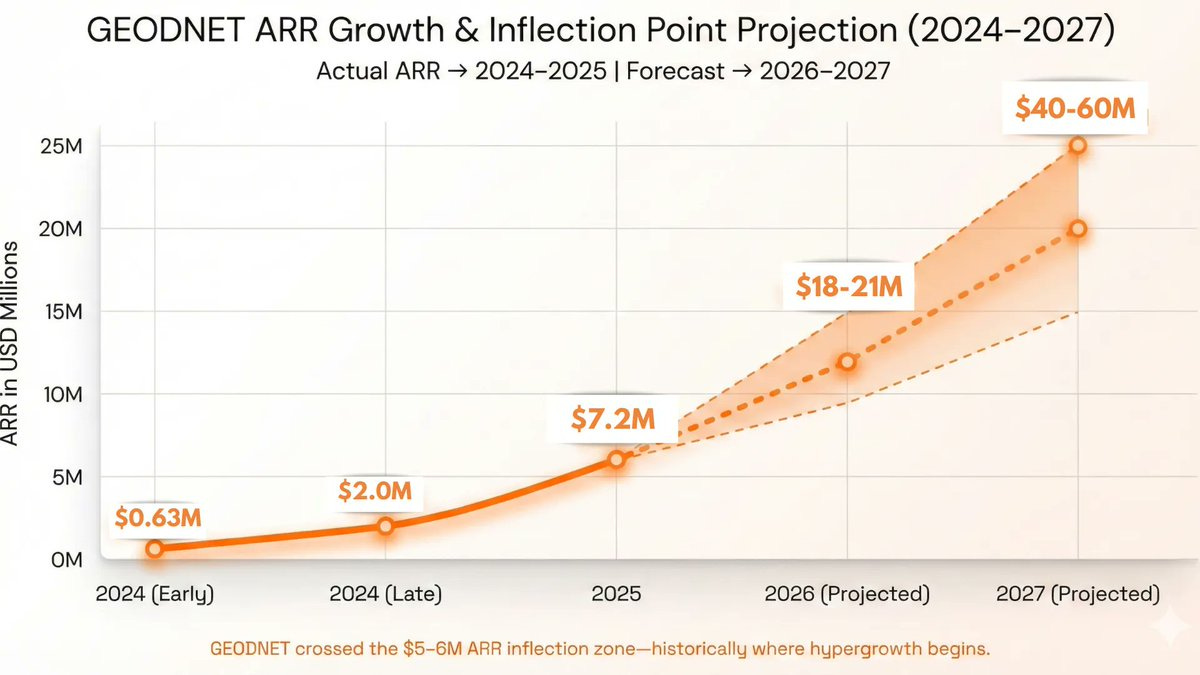

GEOD: Geodnet announced that it’s ARR spiked to > $7m, up from the prior forecasts showing real product market fit as its geospatial awareness DePIN tech becomes hot for the robotics evolution.

PEAQ: Announces that it has hit 6m users (human + AI/devices) as the economic layer for machines gathers some momentum.

XMAQUINA highlights it’s teaming up with PEAQ to breakdown the backbone of robotics capital markets. XMAQUINA’s DEUS token is scheduled to go live soon, with heightened attention as it becomes a proxy for private robotics investment exposure.

2. Crypto AI Agent Analysis

A) Nansen Smart Capital Flow Analysis

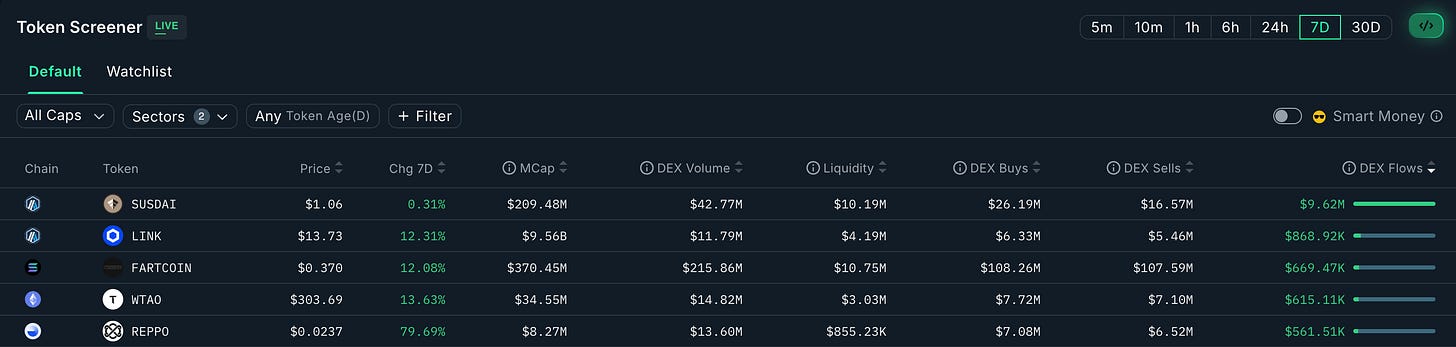

Net capital flows show several usual suspects with decent net inflows:

SUSDAI: Deposits remains open as the $875m cap is yet to be reached, but we see another $10m in inflows as more SUSDAI is minted for its GPU backed yield

Chainlink rolls out its “Link Everything” campaign as it brings the world onchain through a new vision. Recent AI partnership includes Codec FLOW through its CRE initiative.

Fartcoin saw a resurgence as old advocates see a return to former glory as a leading indicator for a potential bull market given the Boomer TradFi appeal

WTAO has seen some positive price action and inflows coming into the halving which goes live this week. Speculators are going to try front run the supply crunch while others warn of validator reduction and network security concerns.

REPPO caught attention this week within the Virtuals ecosystem. They are “Democratizing Access to AI training data using Prediction Markets”. The robotics angle also captured mindshare as real revenues sparked accumulation:

Reppo’s subnets are scheduled to launch this month.

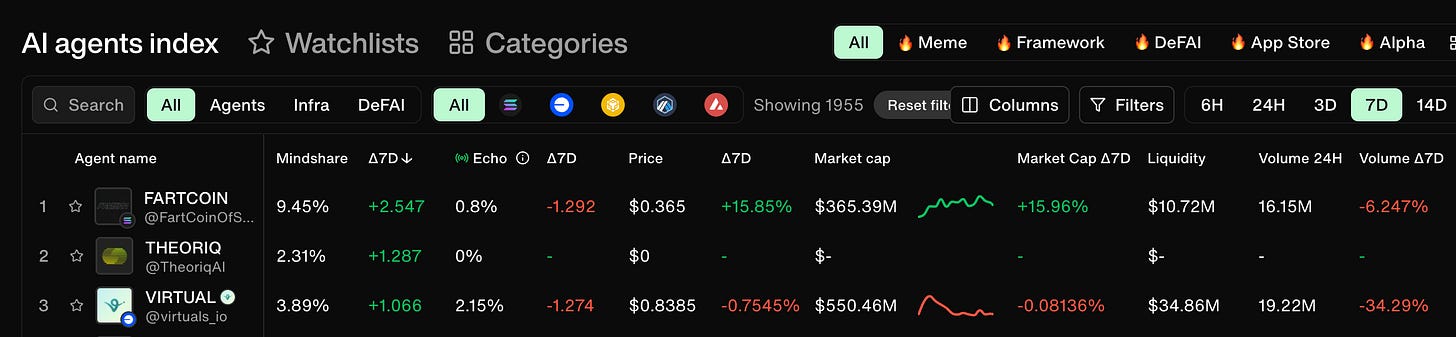

B) Cookie Mindshare Change

This week saw a resurgence in attention on Fartcoin, which also saw a spike in capital flows above. Could we see the stink index return to its former glory?

THEORIQ also caught attention as it gets added to the CoinbaseMarkets roadmap and launches an alpha vault which includes LP incentives.

Virtuals partnered with Openmind, further solidifying itself as a robotics contender within the crypto space

3. AI Agents Developments: Innovations and Market Developments

Here are some other interesting Crypto AI related developments this week:

News this week includes:

BlackRock ‘s “2026 Outlook” ties AI and Crypto Adoption; as the $38 trillion hole in the U.S. Balance Sheet puts crypto as a viable hedge, with AI-boosted mining operations improving efficiency

virtuals_io Protocol is teaming up with openmind_agi. Recently Virtuals made a statement about a move into Robotics with the launch of Subnet 5 (SeeSaw) on the BitRobotNetwork. This partnership with Openmind further bolsters this stance as it helps robots think, learn and work collaboratively

Bybit_Official announces almanak Spot, which will go live alongside the Almanak games. Pledging has also been revealed to reward users with a long term alignment

cerebro_hq is no longer isolated to portfolio analystics, you can now trade any token across 50+ chains using the most optimal routes with Zero fees

ASI Alliance (Fetch_ai) Singularity Compute, the alliance’s infrastructure arm, activated its first enterprise-grade Nvidia GPU cluster in Sweden

telegram ’s Cocoon Launch (GPU owners can now rent computation for Toncoin rewards). This sparks 70% Jump in DeepSnitchAI who “sniff rugs, track whales & drop alpha”

EntreeCap Launches $300M AI Agents & DePIN Fund late last month

useBackroom prepares for its first ICM raise as $FAN goes live tomorrow. FDV min/max: 345k - 690k, Soft/Hard Cap: $75k/$150k

ADIChain_ Mainnet and $ADI token will launch tomorrow. Some will recognise this from “TravAI” - an AI-enabled travel manager that was announced alongside NEARProtocol

TimDraper acknowledges ArAIstotle as a leader in AI truth-seeking; strong traction outside of our crypto world. $FACY has previously been acknowledged by FundstratCap

ACO_labs launches on Monad for onchain AI video creation with pre-made prompts and integrated payments. Keep an eye on this protocol as some exciting announcements are primed ready for enhancements in AI video content

ActionModelAI (community-owned Large Action Model (LAM)) partners with ethos_network: “Ethos users will receive early access to the Action Model ecosystem, unlocking unique benefits, profit-sharing rights, verified creator badges, and token rewards”

vooi_io Season 2 goes live today, which includes 25 Epochs of point accumulations. Something tells me S1 rewards will be valuable for the TGE which can’t be far off, surely?? This AI powered Perp DEX aggregator is backed by YZiLabs (Binance)

OzakAGI partners with PythNetwork and Hive Intel, bolstering its pricing data and DePin integration

useTria was featured on the biggest Korean financial TV station, Korea Economy TV. Prime distribution ahead of the TRIA TGE, which is fast approaching

That’s a wrap for issue 154 of S4mmy’s Snippets. I hope you enjoyed it.

Please leave me any questions or thoughts here - I will respond to everyone!

If you found this interesting, please consider subscribing to this Substack and following me on X for more related insights.

Disclaimer: The content covered in this newsletter is not to be considered investment or financial advice. It is for informational and educational purposes only.

I hold some of the assets and have partnerships with some of the projects mentioned in this newsletter.

Nice roundup on the DeAI landscape. GEODNET jumping to $7m ARR is probably the most concrete signal here, because actual revenue always beats speculation. The TAO halving is geting all the attention, but honestly the real story is whether those subnets can sustain demand post-crunch. Reppo's upcomming subnets could be the wildcard.